If you filed a tax return for the previous tax year, 2018, or current tax year, 2019, you will get a payment in the form of a direct deposit or check mailed. However how much you receive will depend on your Adjusted Gross Income (AGI).

For full size image Here

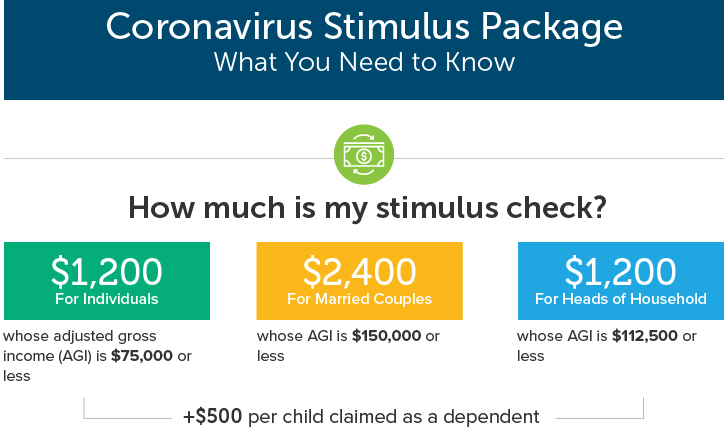

People with an adjusted gross income of up to

$75,000 for single individuals will receive the up to $1,200 payment. This will begin to phase out depending on your AGI. If your AGI is over $99,000 then you will receive nothing. People who file as

Head of household and their AGI is under $125,000 will also receive $1,200 payment.

People with an adjusted gross income of up to

$150,000 for married couples filing joint returns will receive up to $2,400. This will begin to phase out depending on your AGI. If your AGI is over $198,000 then you will receive nothing.

You will receive an

additional $500 for each qualifying child under 17, whom you filed as a dependent on your 2018 or 2019 return.

Social Security beneficiaries who are not typically required to file tax returns

will not need to file an abbreviated tax return to receive an Economic Impact Payment. Instead, payments will be automatically deposited into their bank accounts. The IRS will use the information on the Form SSA-1099 or Form RRB-1099 to generate Economic Impact Payments to recipients of benefits reflected in the Form SSA-1099 or Form RRB-1099 who are not required to file a tax return and did not file a return for 2018 or 2019.

This includes senior citizens, Social Security recipients and railroad retirees who are not otherwise required to file a tax return.

There are some Taxpayers, US Citizens or Resident Aliens (Green Card), who typically do not need to file an income tax return or have not filed an income tax return in the previous two years. (Not including SSN recipients as your situation is mentioned above)

To receive your Payment you will need to submit your information to the IRS. There are some rules and instructions to follow.

Go to the IRS Official Gov Website and click "Non-Filers: Enter Payment Info Here"

What if my income for 2020 is less than 2018 or 2019? Will I get more money?

The Economic Impact Payment is based on your 2019 or 2018 AGI. Some of you may receive very little to $0 payment even though you may have lost your job or had your hours drastically reduced.

However do not worry, although you may not receive the payment now,

the credit will be reconciled on the 2020 return so you will receive a higher credit on your 2020 return based on reduced AGI for 2020. You still get the difference as a credit on your 2020 return. To put it simply, you will owe less tax.

Where is my Economic Impact Payment?

Go to IRS Official Gov website and click, "Get My Payment."

Enter all the information the website requests. Make sure this matches your 2019 or 2018 information. This is similar in format to the “Where is My Refund” webpage.

If your payment is being processed, the following message will be displayed. It will display when is your expected payment date (Direct Deposit) and to which bank account using the last four digits.

If payment has not been processed yet, “Get My Payment” also allows people a chance to

(*Recommended*) provide their bank information. People who did not use direct deposit on their last tax return will be able to input information to receive the payment by direct deposit into their bank account, expediting receipt.

All others will have to wait for a paper check. If the bank account listed on this website is wrong or is an older, closed account, the payment will return to the IRS, but then you will have to wait for a paper check. There is no way around that.

Rules and Regulations:

Information You will Need to Provide:

- Full name, current mailing address and an email address

- Date of birth and valid Social Security number

- *Recommended* Bank account number, type and routing number

- Optional Identity Protection Personal Identification Number (IP PIN) you received from the IRS earlier this year

- Optional Driver’s license or state-issued ID

- For each qualifying child: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse

Follow these steps in order to provide your information:

- Create an account by providing your email address and phone number; and establishing a user ID and password.

- You will be directed to a screen where you will input your filing status (Single or Married filing jointly) and personal information. Note: Make sure you have a valid Social Security number for you (and your spouse if you were married at the end of 2019) unless you are filing “Married Filing Jointly” with a 2019 member of the military. Make sure you have a valid Social Security number or Adoption Taxpayer Identification Number for each dependent you want to claim for the Economic Impact Payment.

- Check the “box” if someone can claim you as a dependent or your spouse as a dependent.

- Complete your bank information (otherwise we will send you a check).

- You will be directed to another screen where you will enter personal information to verify yourself. Simply follow the instructions. You will need your driver’s license (or state-issued ID) information. If you don’t have one, leave it blank.

- You will receive an e-mail from Customer Service at Free File Fillable Forms that either acknowledges you have successfully submitted your information, or that tells you there is a problem and how to correct it. Free File Fillable forms will use the information to automatically complete a Form 1040 and transmit it to the IRS to compute and send you a payment.