|

-Editor's Commentary-

A lot of people are realizing that when it comes to planning there is not a lot that can be done proactively with 2018 taxes unless they are a business owner. There are lots of changes on the business side.

The good news is the 20% pass through Section 199A deduction. The professional/personal service business will see their benefit phase out when the owner hits a certain limit.

Just because the C corporation tax rate went down to 21% it's still a red herring. The average small business owner should stay away from C corporation not only because of double taxation but also it's ended up with paying more income tax.

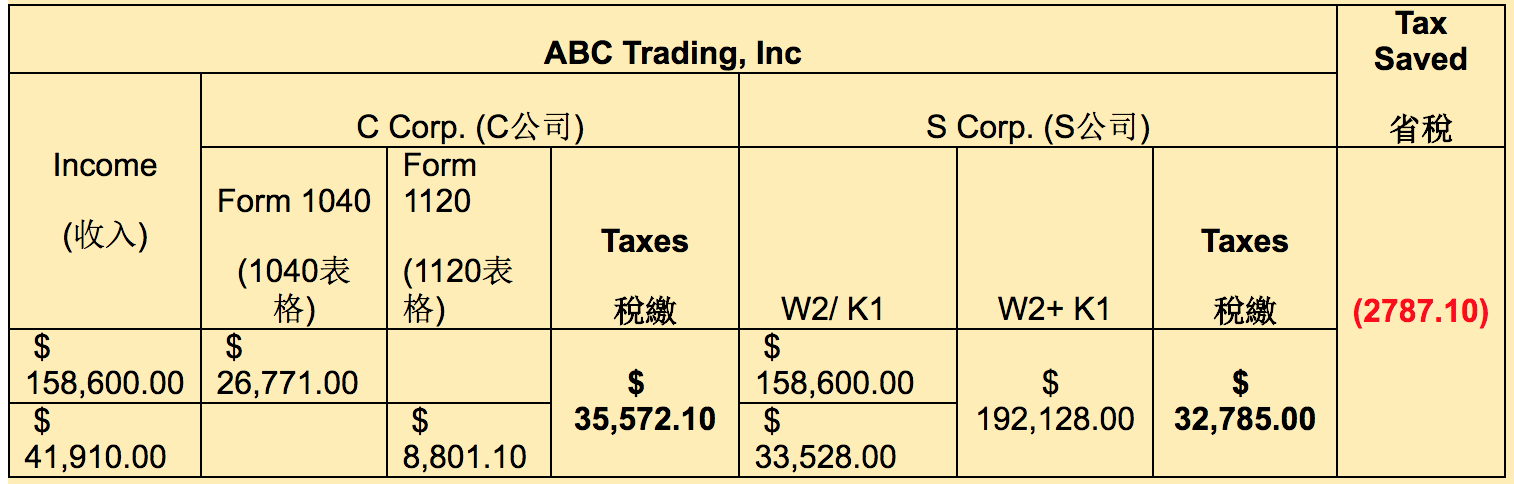

Based on the new tax reform law, we have calculated and illustrated taxes a small business owner will need to pay in tax year 2018 in the following example:

Case Analysis

The owner of ABC Trading, Inc has an annual income of $158,600 ($78,600 from W2 and $80,000 from rent), the company’s total revenue is $537,724, and the net profit is $41,910.00.

If the owner files with C Corp, the company requires paying $ 8,801.10, and the household income tax is 22%, which subjects to pay $26,771 on personal tax, adds up to $35,572.10.

If the owner files with S Corp, the company's net profit will be incorporated into household income in the form of K-1, and household income tax will increase to 24%. Thanks to the 20% net profit reduction of Pass-through companies that benefit from the new tax law, household income only increases to $192,128 ($78,600+$80,000+80%*$41,910). The owner only pays $32,785 on taxes.

很多人都意識到, 除非他們是企業主, 否則可以主動採取2018年的稅收措施並不多. 商業方面有很多變化.

好消息是第199A條商業稅轉價個人稅的20%抵扣福利通過了, 但專業/個人服務業務的業主達到一定限制后將失去他們的福利.

僅僅因為C公司的稅率下降到21%,它仍然是一種噱頭把戲. 一般的小企業主應該遠離C公司,不僅因為雙重徵稅,而且最終還要支付更多的所得稅.

根據新的稅收改革法,我們計算並比較說明了小企業主在2018年納稅年度需要支付的稅款,如下例所示:

事例分析

ABC Trading, Inc公司老板的家庭年收入为$ 158,600 (包括 $78,600 的w2工资和$80,000的房租收入),公司的总收入是$537,724,净利润是$ 41,910.00.

如果以C Corp报税,公司需缴税$ 8,801.10, 家庭收入是22%的税率,需缴纳$ 26,771,

公司和个人一共需缴纳 $35,572.10.

如果以S Corp 报税,公司的净利润会以K-1形式并入家庭收入,家庭收入提升至24%的税率。得益于新税法的納稅中間實體類型公司的20%净利润减免,所以家庭收入只增加至 $192,128 ($78,600+$80,000+80%*$41,910)现只需缴纳 $32,785的税.

|